Other parts of this series:

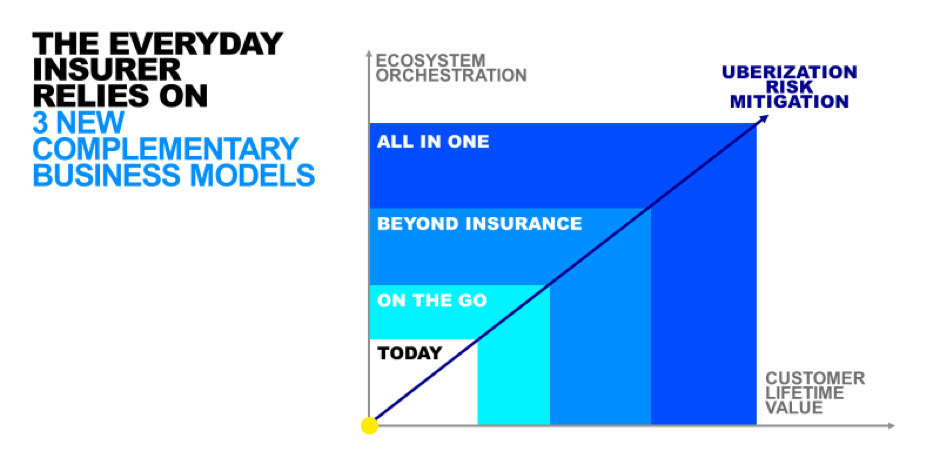

My previous post defined the concept of an Everyday Insurer. Let’s take the idea further by looking at three complementary Everyday Insurance business models carriers can adopt to increase their relevance to the customer.

The On-the-Go Insurer: The carrier provides convenient insurance products or services—often usage-based or pay-per-use—embedded in other products and services consumers use every day. Computer-generated advice will play an increasing role in the sale of such offerings.

These products and services will typically be sold through digital platforms such as Google, Apple, Uber and Facebook or aggregators or plugged into other offerings like Internet of Things devices. Insurers that succeed with on-the-go products will sell not a simple insurance product or service but a living service that develops the customer relationship and customer value over time.

Beyond Insurance: Rather than operating through someone else’s ecosystem, the insurer will orchestrate its own ecosystem that provides customers with an end-to-end solution that spans complementary services to multiple partners. The carrier will attract customers at important moments in their lives by offering them services beyond insurance and then selling them relevant cover—for example, home search and mortgage origination, coupled with homeowners’ insurance, concierge services, and so forth.

The All-in-One Insurer: The insurer offers a complete portfolio of risk mitigation and protection services spanning all the customer’s protection needs, giving him peace of mind. It anticipates the customer’s changing needs as he moves through his lifecycle with the constant support of the carrier, which offers not only insurance cover but also proactive risk prevention and advice.

The final post in the series will look at how insurers can start their transition to the Everyday Insurer paradigm.

Read The Everyday Insurer to find out more.