The way insurers currently view and leverage startups makes them less effective—as a force for transformation and innovation—than they could be. Learn how insurtech could be a catalyst for change.

With the ongoing emergence of new technologies and the increasing use of big data across all industries, including insurance, it’s no surprise that insurtech is a sector that’s growing rapidly. Accenture’s analysis of data to CB Insights found that in 2017 the number of insurtech deals rose by 39 percent compared to those in 2016. And the total value of funding reached US$2.32 billion, a 32 percent increase on 2016. Another indicator of the good health of the sector is what’s happening with seed and angel funding for early-stage startups. The number of deals at this end of the spectrum has almost tripled in the last two years.

But insurtech startups aren’t just well-versed in attracting investments. They’re also inherently good at identifying and releasing trapped value in new and existing markets—something incumbent insurers can learn to.

Companies that successfully and consistently release trapped value have six common characteristics. They are:

- Hyper-relevant, knowing how to be relevant to customers and stay relevant by sensing and addressing their changing needs (such as affordability, social connectedness and the quality of their experiences).

- Hyper-lean, adopting intelligent operations—including automation and digitization of insurance manufacturing, supply chains and functions—to optimize cost structures and free up capacity for innovation.

- Powered by a network, harnessing the power of a carefully managed ecosystem of partners to bring the best innovations to customers.

- Propelled by technology and data, mastering leading-edge technologies and data manipulation to enable business innovation at an unprecedented level and scale.

- Smart about assets, optimizing asset positions to enable a faster shift to new business models, by making bold and timely changes (often at the balance sheet level).

- Champions of an agile workforce, creating new, modern forms of workforces—which are specialized, flexible, augmented and adaptive—required to gain a competitive advantage in existing and new markets.

For traditional insurers, it’s easy to pin the blame for industry disruption on startups, but the reality is the incumbents too could adopt these characteristics, and learn to identify and unlock trapped value.

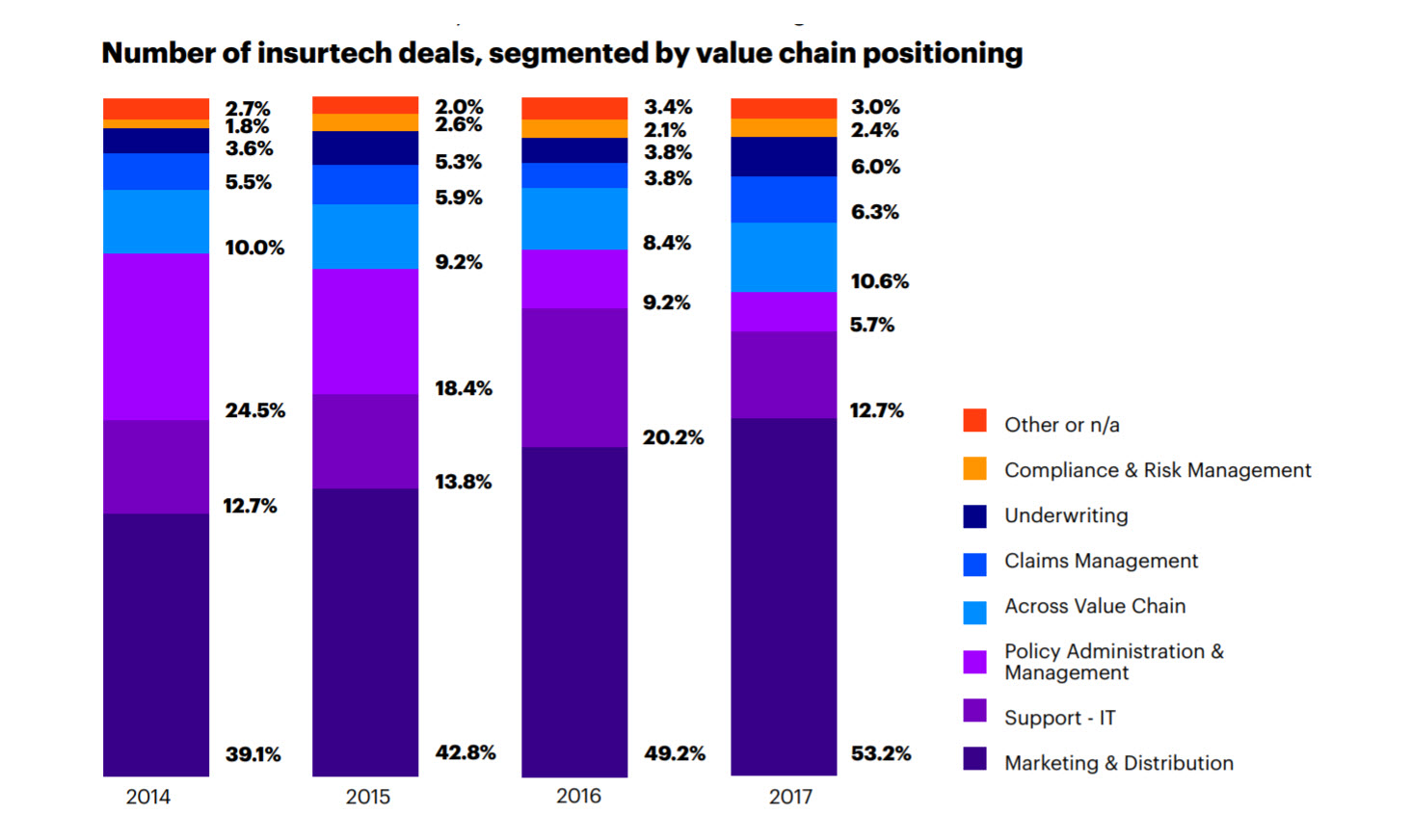

Our research shows that the majority of startups are targeting personal lines, with this category accounting for 68 percent of all deals in 2017. Looking further along the insurance value chain, we see that since 2014 there’s been a strong and steady increase in the number of deals for startups focused on marketing and distribution problems. This is evident at insurtech conferences, where many startups pitch app-based sales and distribution experiences, including those hoping to improve the customer claims journey (through mobile photo-evidencing or chatbot-driven first notice of loss, for example).

Deals are also increasing in other areas, including underwriting and claims management, which indicates that startups are becoming more mature in their approach to the insurance value chain. In the short term, I expect we’ll see more focus on emerging risk too. My advice to insurers wanting to maintain their leading position is to identify value currently trapped in the back end of the value chain and consider ways to release that value.

In my next post, I’ll look at how partnering with insurtechs can help insurers unlocked trapped value.

In the meantime, if you’d like to learn more, read the report: Fearless Innovation: Insurtech as the Change within Insurance